Feb 20, 2022 Step by Step Guide to Prepare for CTP Exam BrainDumps

Certified Treasury Professional CTP Real Exam Questions and Answers FREE Updated on 2022

NEW QUESTION 541

Which of the following statements is true about a forward foreign exchange contract?

- A. It does not require an underlying commercial transaction because the contract trades on its own.

- B. It is a right to buy or sell foreign currency at a specified price within a fixed time period.

- C. It specifies delivery of currencies at an exchange rate established today for a currency transaction that settles more than two days in the future.

- D. It is an exchange of currencies at the outset of a transaction at a fixed rate determined by the spot markets.

Answer: C

NEW QUESTION 542

Amalgamated Binding Consolidators takes 20 days to convert its raw materials to finished goods, 5 days to sell it, and 15 days to collect its credit sales. What is the company's days receivable period?

- A. 20 days

- B. 15 days

- C. 5 days

- D. 40 days

Answer: B

NEW QUESTION 543

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

- A. Maximum long-term debt to capital of 52.5%

- B. Minimum cash flow to total debt of 45%

- C. Minimum working capital of $10,000

- D. Maximum dividends of 50% of net income

Answer: A

NEW QUESTION 544

A pizza restaurant chain maintains separate accounts at bank branches near each of their 1,067 restaurants to handle the deposit of cash received. Early each morning, the company's point-ofsale system electronically transmits collection totals from the previous day to its main computer. ACH debits are then initiated to concentrate the funds from the local accounts to the concentration account the following day. Recently, several of the ACH debits have been returned for insufficient funds because deposits weren't being taken to the bank on a timely basis by the local employees.

Without increasing staff at the restaurants, what could Treasury do to prevent this from happening and avoid overdrafts at the local banks?

- A. Use a courier to deposit to each bank 3 times per week.

- B. Use wire transfers to concentrate the cash instead of ACH.

- C. Install smart safes at each restaurant location.

- D. Negotiate better float schedules at its local banks.

Answer: C

NEW QUESTION 545

The Public Company Accounting Oversight Board (PCAOB):

- A. sets and publishes International Financial Reporting Standards.

- B. sets guidelines used by auditors when performing audits of private companies.

- C. oversees the auditors of public companies and protects investors' interests.

- D. establishes standards for state and local governments.

Answer: C

NEW QUESTION 546

Which of the following are examples of covenants in loan agreements?

I.Financial ratios II.Corporate resolutions III.Borrower limitations IV.Borrower obligations

- A. I and III

- B. II and III

- C. I, II, and IV

- D. I, III, and IV

Answer: D

NEW QUESTION 547

All of the following are reasons to use a confirmed irrevocable letter of credit EXCEPT concern about:

- A. the buyer's ability to pay.

- B. the ability to receive cross-border payments.

- C. foreign currency exposure.

- D. the stability of the buyer's bank.

Answer: C

NEW QUESTION 548

An inverted yield curve occurs when which of the following is true?

- A. As rates on current issues rise, the price of existing issues falls.

- B. The longer the maturity of the investment, the greater the risk of a price decline.

- C. In anticipation of lower long-term rates, investors push short-term rates down.

- D. The longer the maturity of the investment, the lower the rate of return.

Answer: D

NEW QUESTION 549

Which of the following is an example of a Eurobond?

- A. A bond that is denominated in euros, issued in France by a French company.

- B. A bond that is denominated in U.S. dollars, issued in a European market by a U.S. company.

- C. A bond that is denominated in Japanese Yen, issued in the U.K. by a U.S. company.

- D. A bond that is denominated in euros, issued in the U.S. by a German company.

Answer: C

NEW QUESTION 550

U.S. dollar-denominated instruments issued by foreign banks through their domestic branches are known as:

- A. Eurocommercial paper.

- B. banker's acceptances.

- C. Yankee CDs.

- D. Eurodollar CDs.

Answer: D

NEW QUESTION 551

A UK based manufacturer has a subsidiary in Belgium and a manufacturing plant in Italy. The subsidiary wants to sell its products in Sweden. How would the UK parent best structure the movement of funds within the organization to optimize management of working capital while ensuring recourse?

- A. Multilateral netting

- B. Internal factoring

- C. Export financing

- D. Re-invoicing

Answer: B

NEW QUESTION 552

In a maturity matching financing strategy, which of the following is financed using short-term sources?

- A. Equipment

- B. Buildings

- C. Accounts payable

- D. Accounts receivable

Answer: D

NEW QUESTION 553

The future value of $60 invested at 8% compounded per year for three years is:

- A. $74.40.

- B. $64.80.

- C. $75.58.

- D. $47.63.

Answer: C

NEW QUESTION 554

Kensley Biscuit Company Ltd. decides to invest GBP125,000 in new packaging equipment to help it keep up with increased demand. As a result of this investment, the company's annual profit improves by GBP11,763. If Kensley's cost of capital is 8.25% and its corporate tax rate is 42%, what is its residual income (RI) from the investment?

- A. GBP970

- B. GBP11,763

- C. GBP842

- D. GBP1,451

Answer: D

NEW QUESTION 555

A construction company just received a notification from its bank advising it of an altered dollar amount on a check. This notification is MOST LIKELY the result of:

- A. the use of controlled disbursement.

- B. automated reconciliation services.

- C. the use of positive pay.

- D. reverse positive pay.

Answer: C

NEW QUESTION 556

True statements about the open account method of trade payment include which of the following?

I) A bank guarantees payment.

II) It is the most common type of trade credit.

III) A periodic credit review of each customer is required.

IV) The customer makes equal monthly payments.

- A. II and III only

- B. I, III, and IV only

- C. II only

- D. I and IV only

Answer: A

NEW QUESTION 557

Regarding dividends, on which of the following dates would a company's current assets be reduced?

- A. Record date

- B. Ex-dividend date

- C. Payment date

- D. Declaration date

Answer: C

NEW QUESTION 558

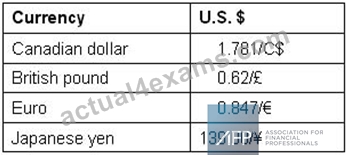

On the basis of the following exchange rates,

which of the following currency amounts has the greatest value in U.S. dollars?

- A. GBP850,000

- B. EUR900,000

- C. JPY5,000,000

- D. C$750,000

Answer: A

NEW QUESTION 559

......

Ultimate Guide to Prepare CTP Certification Exam for Certified Treasury Professional: https://www.actual4exams.com/CTP-valid-dump.html