Steps Necessary To Pass The F2 Exam from Training Expert Actual4Exams

Valid Way To Pass CIMA Management's F2 Exam

NEW QUESTION 38

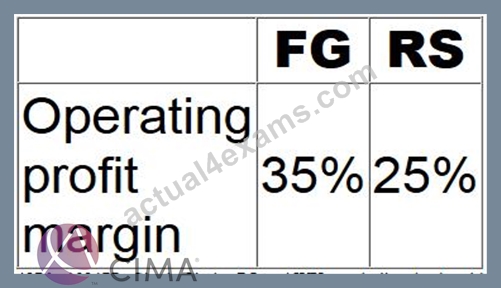

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

- A. RS has a higher level of borrowings and associated finance costs.

- B. RS sold a piece of land for a sum much greater than its carrying value.

- C. RS operates at the low margin end of the market whilst FG operates at the high margin end.

- D. FG has a higher level of deferred tax liabilities than RS.

Answer: C

NEW QUESTION 39

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition.

At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the value of goodwill to be included in the consolidated statement of financial position of ST as at 31 December 20X5?

- A. $1,450,000

- B. $570,000

- C. $450,000

- D. $950,000

Answer: C

NEW QUESTION 40

ST granted 1,000 share appreciation rights (SARs) to its 100 employees on 1 December 20X7. To be eligible, employees must remain employed for 3 years from the grant date. In the year to 30 November

20X8, 10 staff left and a further 20 were expected to leave over the following two years. The fair value of each SAR was $12 at 1 December 20X7 and $15 at 30 November 20X8.

What is the accounting entry to record this transaction for the year to 30 November 20X8?

- A. Dr Staff costs $280,000, Cr Non-current liabilities $280,000

- B. Dr Staff costs $280,000, Cr Equity $280,000

- C. Dr Staff costs $350,000, Cr Non-current liabilities $350,000

- D. Dr Staff costs $350,000, Cr Equity $350,000

Answer: C

NEW QUESTION 41

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively.

Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

- A. In 20X5 the increase in value of MNO's head office was reflected in the financial statements.

- B. In 20X4 an unused building was sold at a price in excess of its carrying value.

- C. In 20X4 an onerous contract was provided for and this provision did not change in 20X5.

- D. In 20X5 the average interest rate on borrowing decreased compared to 20X4.

Answer: C

NEW QUESTION 42

EFG is preparing its financial statements to 31 March 20X8. During the year ended 31 March 20X7, EFG purchased a piece of land for $1 million which is used as the staff car park. EFG has a policy of revaluing land, in accordance with International Accounting Standards, and at 31 March 20X8, accounted for a substantial increase in its value.

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8, which THREE of the following would be expected?

- A. Increase in other comprehensive income.

- B. Decrease in net asset turnover.

- C. Decrease in return on capital employed.

- D. Increase in return on capital employed.

- E. Increase in net asset turnover.

- F. Increase in profit before tax.

Answer: A,B,C

NEW QUESTION 43

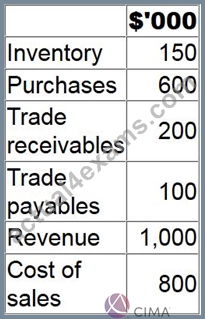

The following information has been extracted from the financial records of DEF for the year ended 31 December 20X2.

What is the operating cycle of DEF at 31 December 20X1?

Assume there are 365 days in the year.

All workings should be rounded to whole days.

Give your answer in whole days.

? days.

Answer:

Explanation:

80, 81

NEW QUESTION 44

Which of the following should be eliminated when using the equity method to account for associates in a parent's financial statements?

Select ALL that apply.

- A. Goodwill payments

- B. Dividends from associates

- C. Unrealised profits

- D. Intra-group balances and transactions

Answer: B,C

NEW QUESTION 45

When preparing a consolidated statement of cash flows, which of the following describes the correct presentation of an associate's dividends?

- A. Dividends paid by the associate in cash flows from financing activities

- B. Dividends paid by the associate in cash flows from investing activities

- C. Dividends received from the associate in cash flows from investing activities

- D. Dividends received from the associate in cash flows from operating activities

Answer: C

NEW QUESTION 46

Following a wedding in October 20X0 ten people contracted food poisoning from eating food cooked by the wedding caterer PQ. At 31 December 20X0 PQ was advised by its legal advisors that a liability was possible but not probable and the incident was disclosed as a contingent liability at that date.

As the result of developments in the case, which is still not settled, PQ was advised that it is now probable, as at 31 December 20X1, that they will be found liable and will therefore have to pay damages of unknown value.

Which of the following would indicate that in the financial statements of PQ for the year ended 31 December 20X1 this should still be recognised as a contingent liability rather than a provision?

- A. The case has not yet been settled.

- B. A present obligation exists as a result of a past event.

- C. It is probable that there will be an outflow of economic resources to settle the case.

- D. There is no reliable estimate of the cost.

Answer: D

NEW QUESTION 47

Which TWO of the following would be the primary disadvantages of producing the disclosures required in IFRS12 Disclosure of Interests in Other Entities?

- A. The disclosures will highlight the risks associated with interests in other entities.

- B. The users of the financial statements may feel overburdened with information.

- C. The auditors will have to audit these disclosures.

- D. The disclosures will give competitors commercially sensitive information.

- E. The disclosures take time and therefore incur costs which erodes shareholder value.

Answer: B,E

NEW QUESTION 48

MS Group's total profit for period on their consolidated income statement is £31,000. This includes adjusting for their share of joint venture JV2. Calculate the share of joint venture MS Group received based on the following information.

MS operating profit £41,000

Dividend from JV2 £5,000

Finance cost £3,000

Tax £11,000

- A. £6,000

- B. £9,000

- C. £5,000

- D. £1,000

- E. £7,000

- F. £4,000

Answer: F

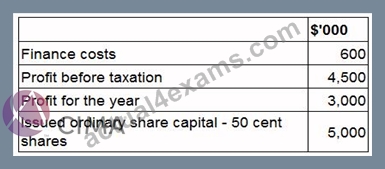

NEW QUESTION 49

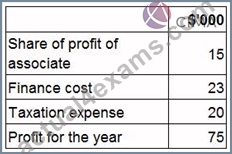

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

- A. 5.1

- B. 4.1

- C. 4.5

- D. 3.3

Answer: C

NEW QUESTION 50

LM are just about to pay a dividend of 20 cents a share. Historically, dividends have grown at a rate of

5% each year.

The current share price is $3.05.

The cost of equity using the dividend valuation model is:

- A. 12.4%

- B. 11.9%

- C. 6.9%

- D. 7.4%

Answer: A

NEW QUESTION 51

LM acquired 15% of the equity share capital of ST on 1 January 20X6 for $18 million. LM acquired a further 50% of the equity share capital of ST for $50 million on 1 January 20X7 when the fair value of ST's net assets was $82 million. The original 15% investment in ST had a fair value of $20 million at 1 January 20X7. The non controlling interest in ST was measured at its fair value of $30 million at the date control in ST was acquired.

Calculate the goodwill arising on the acquisition of ST that LM included in its consolidated financial statements at 31 December 20X7.

Give your answer to the nearest $ million.

$ ? million

Answer:

Explanation:

18, 18000000

NEW QUESTION 52

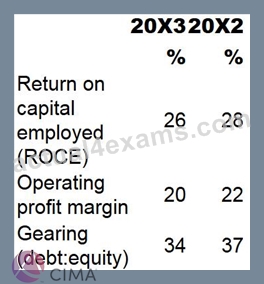

Ratios have been produced below for EF for the year to 31 March:

Which TWO of the following could explain the movement in both gearing and ROCE?

- A. A debt issue on 31 March 20X3.

- B. A revaluation upwards on the head office property on 1 April 20X2.

- C. A rights issue on 31 March 20X3.

- D. A bank loan to purchase new machinery on 31 March 20X3.

- E. A bonus issue of shares on 1 April 20X2.

Answer: B,C

NEW QUESTION 53

GH issued a 6% debenture for $1,000,000 on 1 January 20X4. A broker fee of $50,000 was payable in respect of this issue. The effective interest rate associated with this debt instrument is 7.2%.

The carrying value of the debenture at 31 December 20X4 is:

- A. $958,400

- B. $961,400

- C. $1,012,000

- D. $1,065,600

Answer: A

NEW QUESTION 54

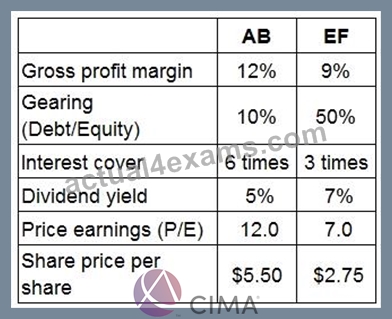

AB and EF are located in the same country and prepare their financial statements to 31 October in accordance with International Accounting Standards. EF supplies AB with a component that is vital to AB's product range. AB is considering acquiring a controlling interest in EF by 31 December 20X4 in order to guarantee future supply. The Board of EF has indicated that such an approach would be postively considered. AB would use its control to make AB the sole customer of EF.

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to

31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

Which of the following independent options would explain the difference between the gearing ratios of AB and EF at 31 October 20X4?

- A. EF's average cost of borrowing is significantly lower than that of AB and EF has taken advantage of that.

- B. EF has a policy of revaluing non current assets whereas AB does not.

- C. EF made a bonus issue of shares from retained earnings during the year whereas AB did not.

- D. EF's market value of shares at 31 October 20X4 is lower than that of AB.

Answer: A

NEW QUESTION 55

Mr D, a CIMA qualified accountant, is working on the preparation of a long term profit forecast required by the local stock market prior to a new share issue of equity shares. At the most recent board meeting the directors requested that the forecast be inflated. In Mr D's view this would grossly overestimate the forecast profit. The board intends to publish the revised inflated forecast.

Which THREE of the following are the ethical options available to Mr D in this situation?

- A. Consider resignation of his post as accountant.

- B. Delegate the work to a subordinate.

- C. Submit the original forecast without the board's approval.

- D. Discuss the situation with his line manager.

- E. Consider reporting the situation to the appropriate authorities.

- F. Adjust the figures in line with the board's request as this is a forecast and not the financial statements.

Answer: A,D,E

NEW QUESTION 56

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

- A. 10.56

- B. 9.31

- C. 7.92

- D. 15.83

Answer: D

NEW QUESTION 57

ST acquired 75% of the 2 million $1 equity shares of CD on 1 January 20X3, when the retained earnings of CD were S3,550,000. CD has no other reserves.

ST paid $5,600,000 for the shares in CD and the non controlling interest was measured at its fair value of S1,400,000 at acquisition.

At 1 January 20X3, the fair value of CD's net assets were equal to their carrying amount, with the exception of a building. This building had a fair value of $1,000,000 in excess of its carrying amount and a remaining useful life of 25 years on 1 January 20X3.

At 31 December 20X5, the retained earnings of ST and CD were $8,500,000 and $5,250,000 respectively.

What is the value of retained earnings that will be presented in the consolidated statement of financial position of ST as at 31 December 20X5?

- A. $9,685,000

- B. $10,080,000

- C. $9,775,000

- D. $9,715,000

Answer: A

NEW QUESTION 58

What is meant by the term "a placing of ordinary shares"?

- A. Selling new ordinary shares to existing shareholders.

- B. Selling new ordinary shares to a financial institution on a pre-arranged basis.

- C. Selling new ordinary shares directly to the public.

- D. Selling existing ordinary shares to new investors through a stock exchange.

Answer: B

NEW QUESTION 59

......

All F2 Dumps and Advanced Financial Reporting Training Courses: https://www.actual4exams.com/F2-valid-dump.html