[Nov 07, 2021] MB-310 Exam Dumps, MB-310 Practice Test Questions

Free MB-310 Study Guides Exam Questions & Answer

The candidates for the Microsoft MB-310 exam must understand its content before attempting to pass it. It is recommended that they go through the official website for the updated details at the point of preparing for the test. The topics covered within the domain of the certification exam are highlighted below:

Defining and Configuring Financial Management (50-55%):

- Manage & implement journals: this subtopic covers the skills in explaining options for the implementation of the voucher numbers within journals; configuring journal names; setting up journal controls & posting limitation rules; explaining and configuring journal approvals; creating voucher templates; explaining use cases for periodic journals; setting up inter-company accounting; configuring and applying accrual schemes;

- Manage & implement bank and cash: this topic covers competence in creating and maintaining bank accounts and bank groups; explaining and configuring electronic payment options; configuring and processing bank reconciliations such as advanced bank reconciliations; configuring cash flow reports;

- Perform periodic processes: this section requires competence in configuring closing schedule and financial period workspace; defining and demonstrating year-end processes and periodic closing processes; performing elimination processes and financial consolidation; configuring the allocation terms for main accounts; creating and processing ledge allocation policies; implementing the revaluation processes for foreign currency; creating and managing financial reports, including report definitions, row, and column;

- Implement cost management & cost accounting: the potential candidates should have the skills in explaining cost accounting terms and processes; configuring cost accounting procedures; creating cost accounting reports with the use of the Cost Accounting Report wizard; explaining and configuring indirect costs and costing sheet.

- Configure, collect, and report taxes: the learners need to show competence in configuring tax groups, settlement periods, jurisdiction, and tax codes; configuring tax ledger posting groups; preparing the periodic filings, such as year-end tax reporting.

- Define & configure charts of accounts: this objective requires that the applicants demonstrate competence in defining and configuring charts of accounts & main accounts; explain the use cases for main accounts categories, balance control accounts, and ledger account aliases; configuring financial dimension & dimension sets; configuring legal entity overrides for main accounts and financial dimensions; creating and configuring account structures & advanced rules;

- Configure currencies & ledgers: the candidates should be able to construct fiscal years, periods, and calendars; configure ledgers; explain and configure the batch transfer rules; configure conversions and currencies for legal entities; configure the currency exchange rate providers; enter the currency exchange rates manually;

The area will also measure one’s skills in configuring cost groups and cost objects, implementing inventory costing versions, differentiating between the inventory costing methodologies, configuring posting profiles and item groups, as well as performing adjustment processes and inventory closing.

You can read the Microsoft MB-310 Certification Exam Requirements

Candidates for this exam have a basic understanding of the concepts of corporate accounting and finance, customer service, field service, manufacturing, retail, and supply chain management.

Applicants for this exam usually train in one or more sets of Microsoft Dynamics 365 Finance functions, including finance, manufacturing, and supply chain management. Applicants must have knowledge of basic accounting principles and practices.

- Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate

MB-310 Exam Outline

This validation comprises about 40 to 60 questions in total and 3 hours will be given to complete all of them. Following are some question formats that are used generally by the vendor when it comes to the official tests:

- Hot area;

- Case studies;

- Multiple-choice;

- Labs;

- Drag & drop;

- Short answer, etc.

To mention the registration process briefly, as the first step you are required to log into your account at Pearson VUE and then choose the relevant section. Next, enter the exam code and complete your registration by following the notifications. Note that Microsoft offers this MB-310 test in English for $165.

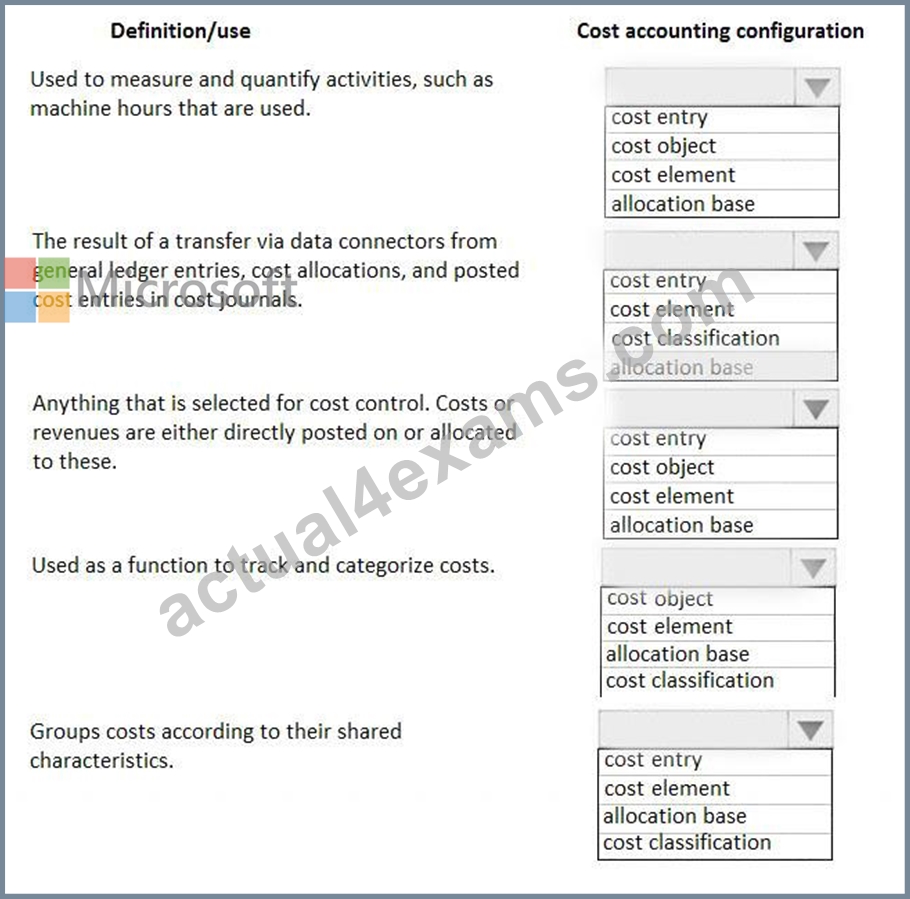

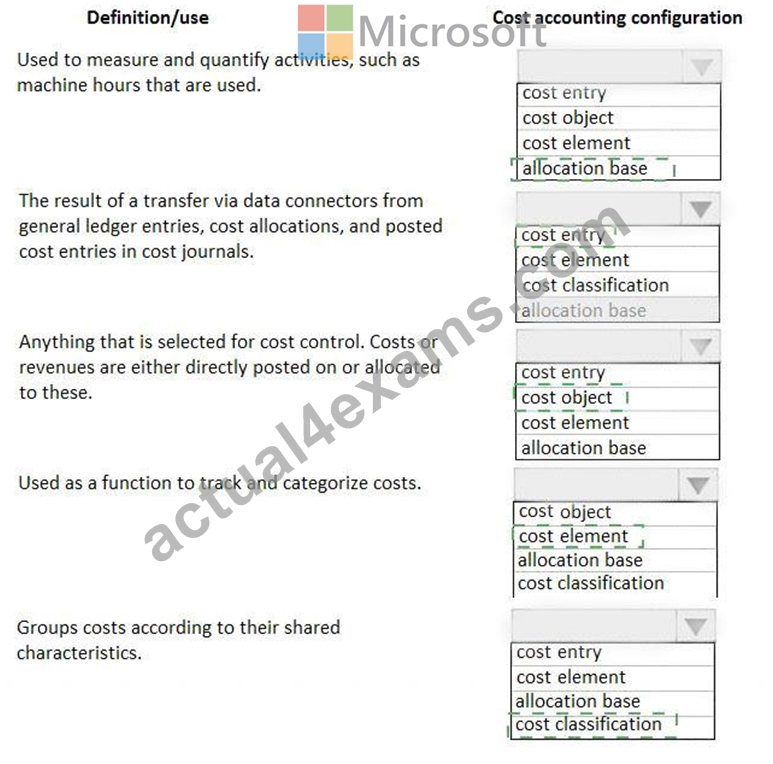

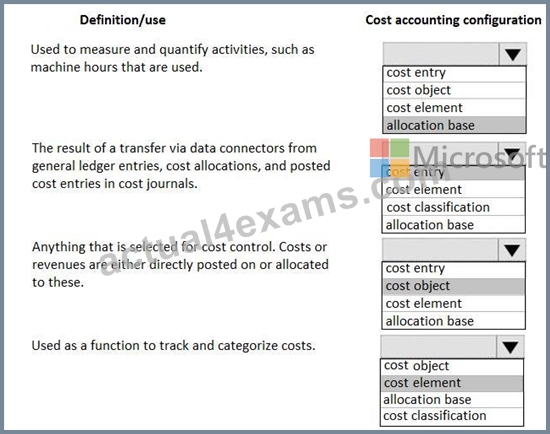

NEW QUESTION 57

A client plans to use the cost accounting module in Dynamics 365 for Finance and Operations. You need to associate the correct definitions to the correct cost accounting concepts. Which terms match the definitions?

To answer, select the appropriate configuration in the answer are3. NOTE: Each correct selection is worth one point.

Answer:

Explanation:

Explanation

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/cost-accounting/terms-cost-accounti

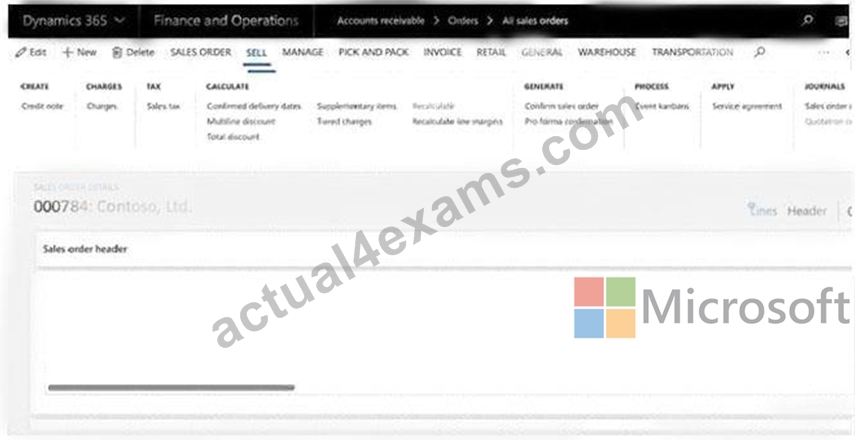

NEW QUESTION 58

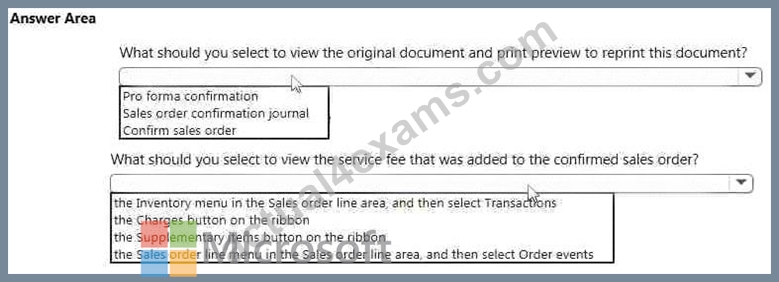

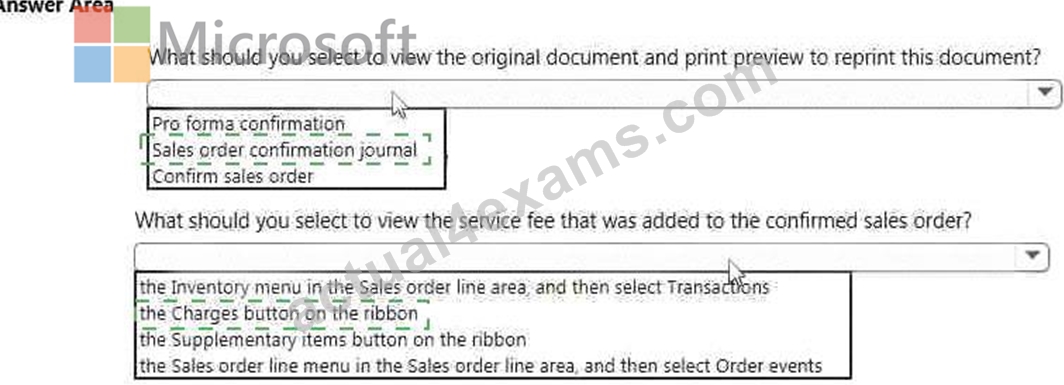

A client confirms a safes order in Dynamics 365 for Finance and Operations. You are viewing the confirmed sales order.

Answer:

Explanation:

Explanation

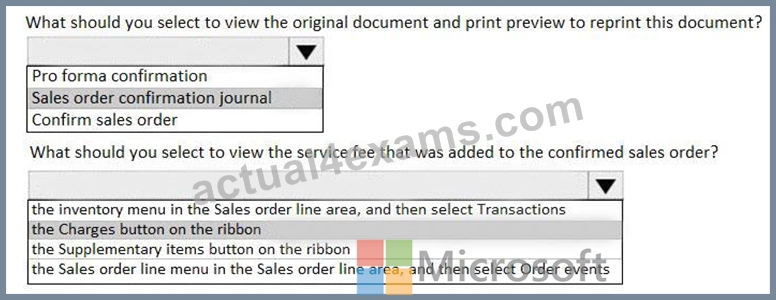

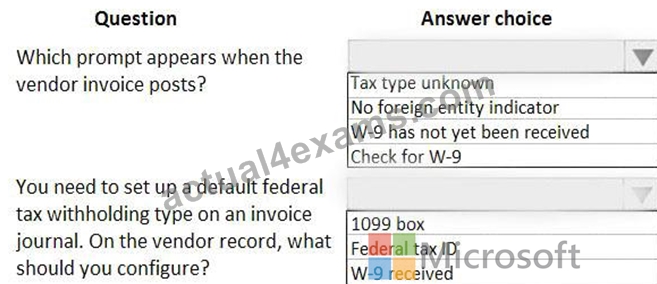

NEW QUESTION 59

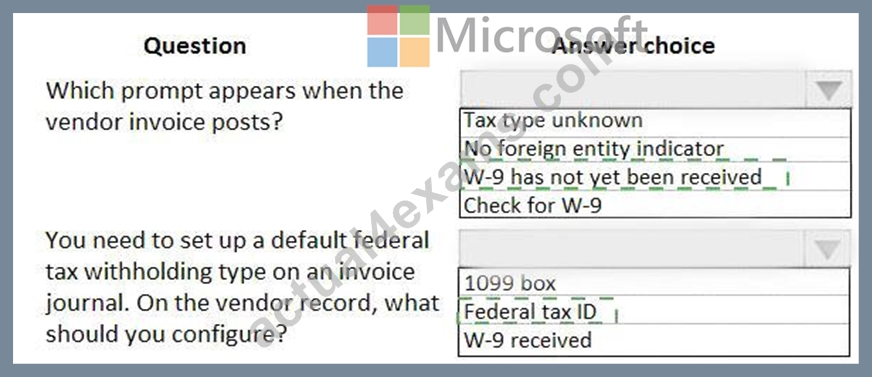

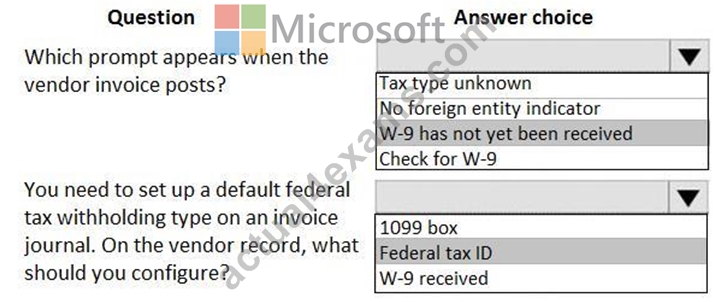

A client plans to use Dynamics 365 for Finance and Operations for year-end 1099 reporting in the United States. You are viewing a vendor master data record on the 1099 FastTab.

Answer:

Explanation:

Explanation

NEW QUESTION 60

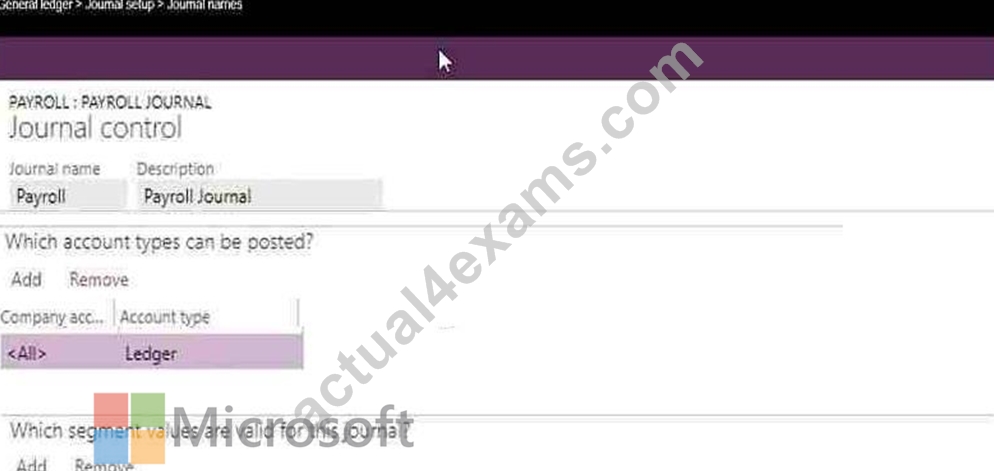

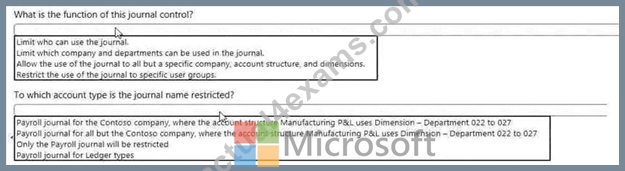

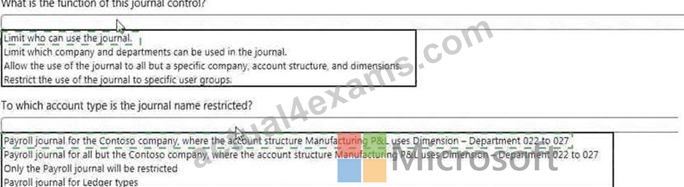

You must configure journal controls in Dynamics 365 for Finance and Operations.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic

Answer:

Explanation:

NEW QUESTION 61

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

You need to implement a quarterly accruals scheme for USMF. The accrual scheme settings must match the settings of the monthly and annual accrual schemes.

To complete this task, sign in to the Dynamics 365 portal.

- A. Look at the monthly and annual accrual scheme settings. Create a quarterly accrual scheme with the same settings by using the following instructions:

* Go to Navigation pane > Modules > General ledger > Journal setup > Accrual schemes.

* Select New.

* In the Accrual identification field, type a value.

* In the Description of accrual scheme field, type a value.

* In the Debit field, specify the desired values. The main account defined will replace the debit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

* In the Credit field, specify the desired values. The main account defined will replace the credit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

* In the Voucher field, select how you want the voucher determined when the transactions are posted.

* In the Description field, type a value to describe the transactions that will be posted.

* In the Period frequency field, select how often the transactions should occur.

* In the Number of occurrences by period field, enter a number.

* In the Post transactions field, select when the transactions should be posted, such as Monthly. - B. Look at the monthly and annual accrual scheme settings. Create a quarterly accrual scheme with the same settings by using the following instructions:

* Go to Navigation pane > Modules > General ledger > Journal setup > Accrual schemes.

* Select New.

* In the Accrual identification field, type a value.

* In the Debit field, specify the desired values. The main account defined will replace the debit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

* In the Credit field, specify the desired values. The main account defined will replace the credit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

* In the Voucher field, select how you want the voucher determined when the transactions are posted.

* In the Number of occurrences by period field, enter a number.

* In the Post transactions field, select when the transactions should be posted, such as Monthly.

Answer: A

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-accrual-schemes

NEW QUESTION 62

You are setting up the yearly budget for an organization for the year 2019.

You need to set up the budget register entries.

Which two fields must be set up when creating register entries? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- A. Budget code

- B. Budget manager

- C. Budget cycle

- D. Budget model

Answer: A,D

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/budgeting/basic-budgeting-overview-configuration

NEW QUESTION 63

You work for a company that receives invoices in foreign currencies.

You need to configure the currency exchange rate providers and exchange rate types.

What should you do?

- A. Configure exchange rate provider, create exchange rate type, and import the currency exchange rates.

- B. Select the appropriate HTML key values from the available exchange rate providers. Then, use the provider for importing one currency exchange.

- C. Use a developer to write the XML key values code to configure the currency exchange rate providers.

Then, use the provider for importing a currency exchange rate type. - D. Use a developer to write the HTML key values code to configure the currency exchange rate providers.

Then, use the provider for importing a currency exchange rate type.

Answer: A

Explanation:

Section: Manage and apply common processes

Explanation

Explanation/Reference:

References:

https://community.dynamics.com/365/financeandoperations/b/365operationsbysandeepchaudhury/posts/ configure-currency-exchange-rate-providers-and-import-exchange-rates-automatically-in-dynamics-365-for- finance-and-operations

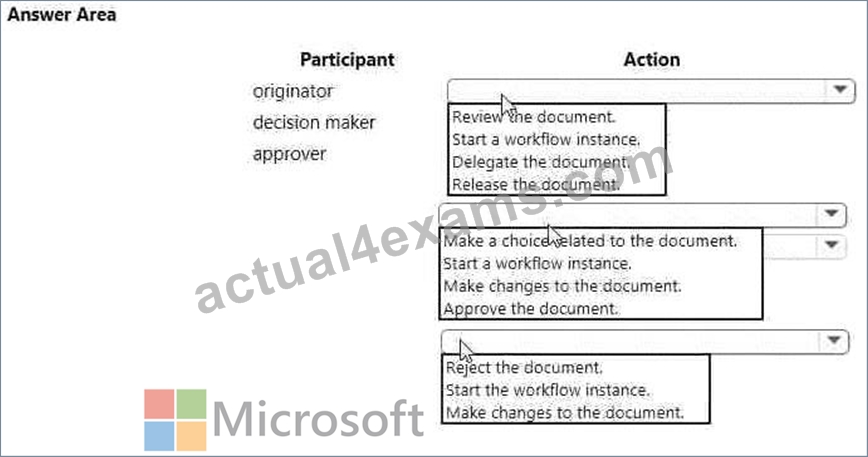

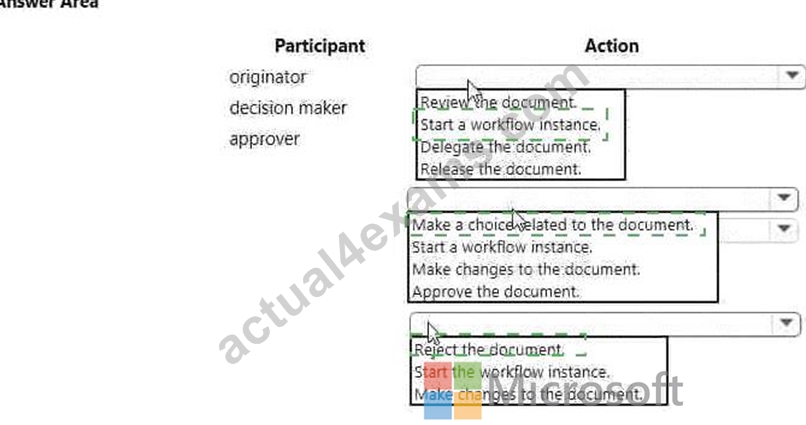

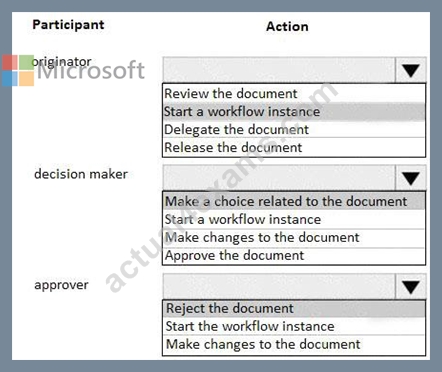

NEW QUESTION 64

You are setting up of the process for an expense report approval in Dynamics 365 for Finance and Operations.

You need to assign permission for each participant in the workflow approval process to perform their tasks.

Which action can each participant perform? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

Answer:

Explanation:

Explanation

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/fin-and-ops/organization-administration/workf

NEW QUESTION 65

A client has one legal entity and the following four dimensions configured: Business Unit, Cost Center, Department, and Division.

You need to configure the client's system to run the trial balance inquiry in the General ledger module so that it displays the trial balance two ways:

*Include the main account and all four dimensions.

*Include the main account and only the business unit and cost center dimensions.

What should you configure?

- A. two derived financial dimension hierarchies

- B. two financial dimension sets

- C. all financial dimensions by using the group dimension functionality

- D. two account structures

Answer: B

NEW QUESTION 66

A client has unique accounting needs that sometimes require posting definitions.

You need to implement posting definitions.

In which situation should you implement posting definitions?

- A. when the system needs to automatically post a transaction to the accounts receivable account on invoice posting

- B. when creating one offset ledger entry based on transaction type

- C. when using encumbrance accounting for purchase orders

- D. when financial dimensions need to default from the main account onto an invoice

Answer: C

Explanation:

Explanation

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/posting-definitions

NEW QUESTION 67

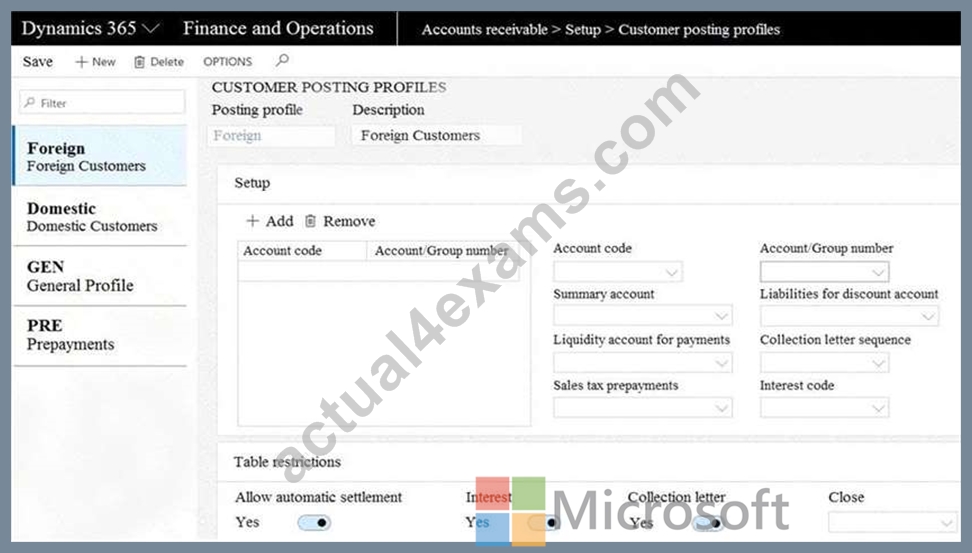

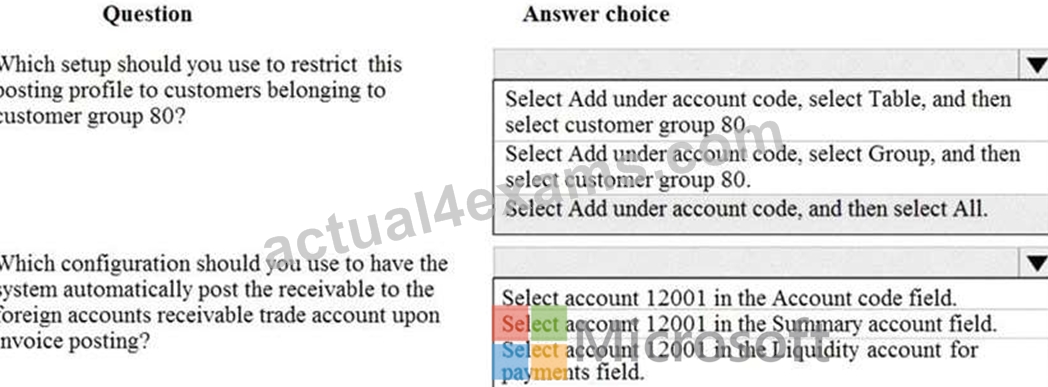

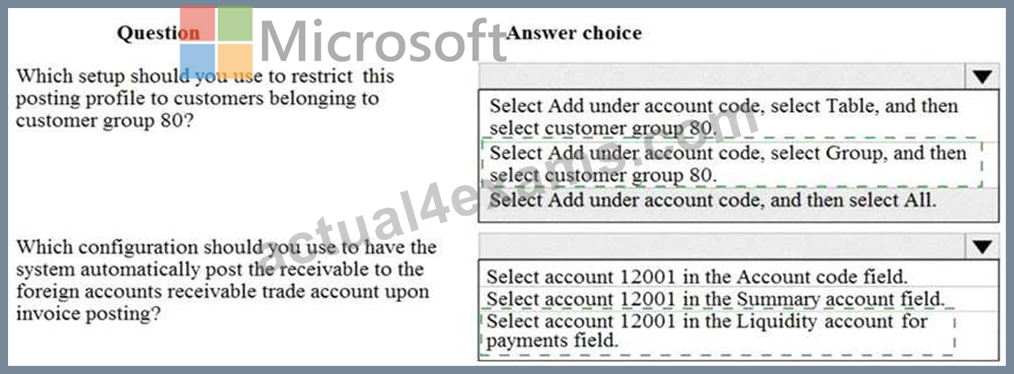

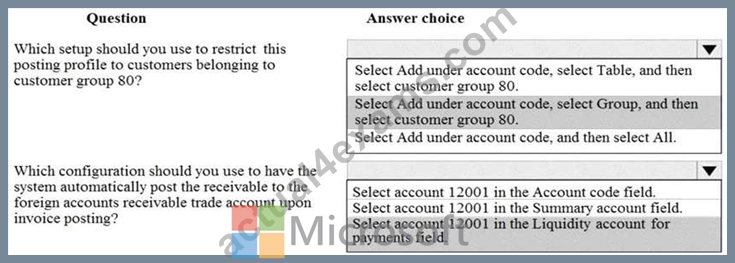

A client is using Dynamics 365 Finance for sales order processing and accounts receivable. The client has two customer groups and two Accounts receivable trade accounts. Foreign customers in Group 80 are assigned to account 12001. Domestic customers in Group 40 are assigned to account 12000.

You are viewing the client's current setup of Customer posting profiles.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Answer:

Explanation:

Explanation

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/customer-posting-profiles

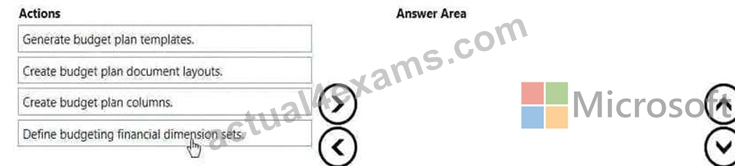

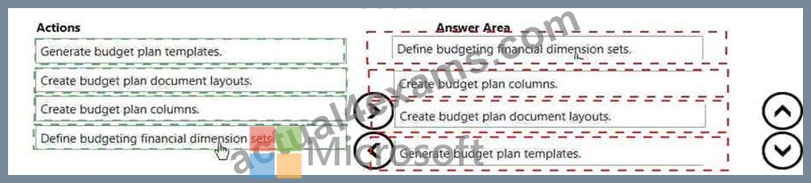

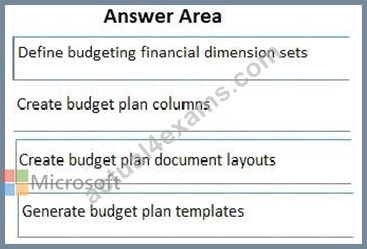

NEW QUESTION 68

A company needs to create budget plan templates for its budgeting process.

You need to create the budget plan templates.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

Answer:

Explanation:

Explanation

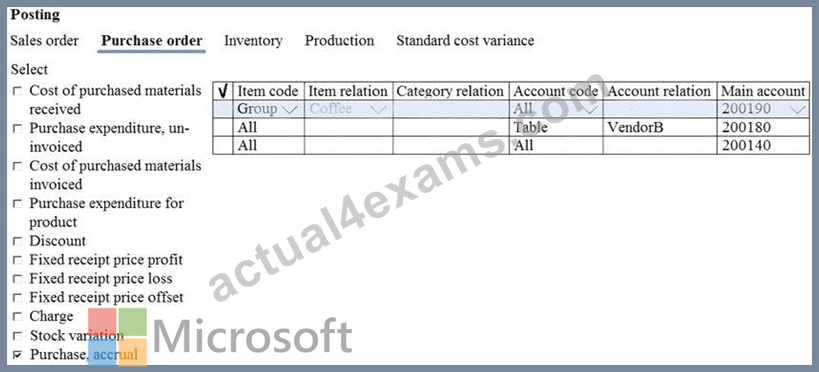

NEW QUESTION 69

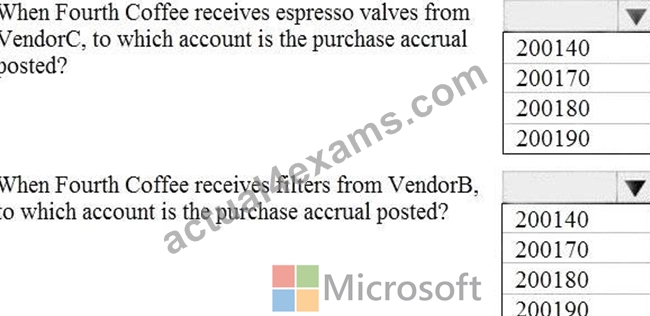

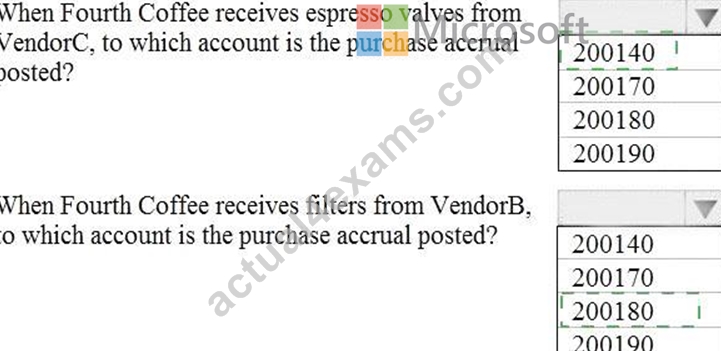

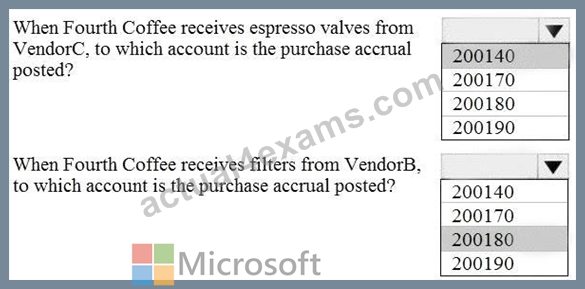

The posting configuration for a purchase order is shown as follows:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Answer:

Explanation:

Explanation

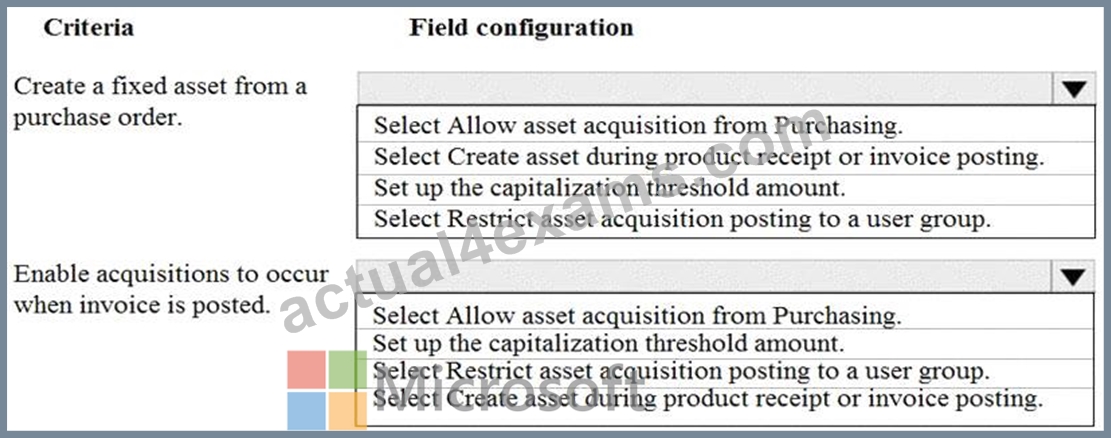

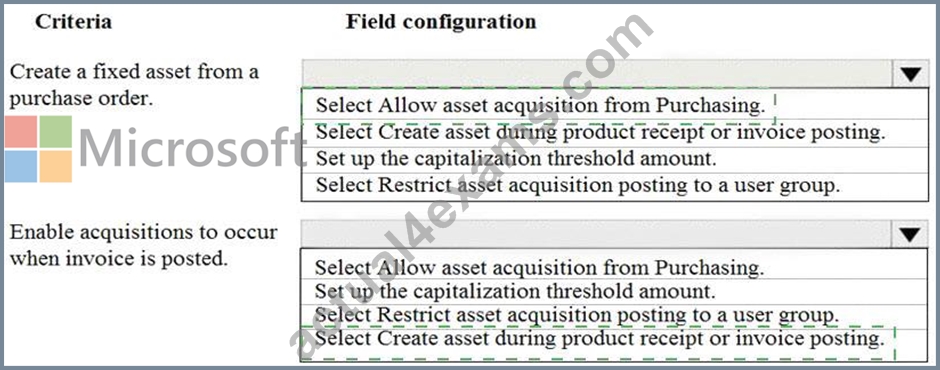

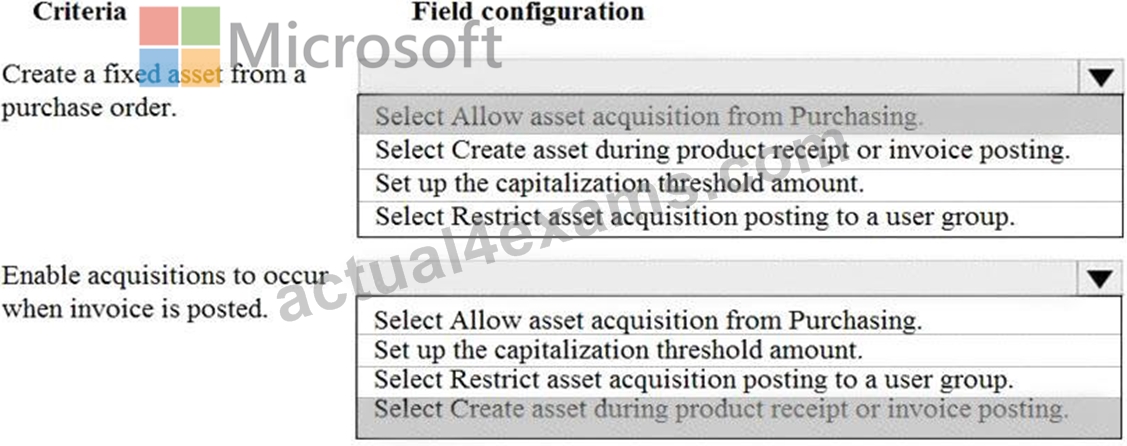

NEW QUESTION 70

You are the purchase manager of an organization. You purchase a laptop for your office for $2,000. You plan to create a purchase order and acquire the new fixed asset through the purchase order at time of invoicing.

You set up the system as follows: Fixed assets are automatically created during product receipt or vendor invoice posting and the capitalization threshold for the computers group (COMP) is set to $1,600.

You need to automatically create a fixed asset record when you post an acquisition transaction for the asset after you post the invoice.

How should you configure the fixed asset parameters to meet the criteria? To answer, select the appropriate option in the answer area.

NOTE: Each correct selection is worth one point.

Answer:

Explanation:

Explanation

NEW QUESTION 71

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A company is preparing to complete yearly budgets.

The company plans to use the Budget module in Dynamics 365 Finance for budget management.

You need to create the new budgets.

Solution: Create budget plans for multiple scenarios.

Does the solution meet the goal?

- A. No

- B. Yes

Answer: B

Explanation:

Explanation/Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/budget-planning- overview-configuration

NEW QUESTION 72

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF plans to implement a new manufacturing department that will be based in Australia.

You need to create a draft account structure for the new department. The account structure must use the same account structure as a department named Manufacturing India and be named Manufacturing Australia.

To complete this task, sign in to the Dynamics 365 portal.

- A. You need to create an account structure with the same structure as the department named Manufacturing India by using the following instructions.

* Go to Navigation pane > Modules > General ledger > Chart of accounts > Structures > Configure account structures.

* On the Action pane, click New to open the drop dialog.

* In the Account structure field, type a name to describe the purpose of the account structure.

* In the Description field, type a description to specify the purpose of the account structure.

* Click Create.

* In the Segments and allowed values, click Add segment.

* In the dimensions list, select the dimension to add to the account structure.

* At the end of the list, click Add segment.

* Repeat step 6 to 9 as needed.

* In the Allowed value details section, select the segment to edit the allowed values. For example, click the Main Account field.

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 600000.

* In the through field, type a value. For example, 699999.

* In the Allowed value details section, click Apply.

* Repeat step 10 to 15 as needed.

* In the Allowed value details section, click Add new criteria.

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 033.

* In the through field, type a value. For example, 034.

* Click Apply.

* In the grid, select the segment to edit the allowed values. For example, Cost Center.

* In the CostCenter field, type a value. For example, 007..021.

* In the Segments and allowed values, click Add.

* In the MainAccount field, type a value. For example, 600000..699999

* In the grid, select the segment to edit the allowed values. For example, Department.

* In the Department field, type a value. For example, 032.

* In the CostCenter field, type a value. For example, 086.

* On the Action pane, click Validate. - B. You need to create an account structure with the same structure as the department named Manufacturing India by using the following instructions.

* Go to Navigation pane > Modules > General ledger > Chart of accounts > Structures > Configure account structures.

* On the Action pane, click New to open the drop dialog.

* In the Account structure field, type a name to describe the purpose of the account structure.

* In the Description field, type a description to specify the purpose of the account structure.

* Click Create.

* In the Segments and allowed values, click Add segment.

* In the dimensions list, select the dimension to add to the account structure.

* At the end of the list, click Add segment.

* Repeat step 6 to 9 as needed.

* In the Allowed value details section, select the segment to edit the allowed values. For example, click the Main Account field.

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 600000.

* In the through field, type a value. For example, 699999.

* In the Allowed value details section, click Apply.

* Repeat step 10 to 15 as needed.

* In the Allowed value details section, click Add new criteria.

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 088.

* In the through field, type a value. For example, 034.

* Click Apply.

* In the grid, select the segment to edit the allowed values. For example, Cost Center.

* In the CostCenter field, type a value. For example, 007..021.

* In the Segments and allowed values, click Add.

* In the MainAccount field, type a value. For example, 600000..698888

* In the grid, select the segment to edit the allowed values. For example, Department.

* In the Department field, type a value. For example, 032.

* In the CostCenter field, type a value. For example, 086.

* On the Action pane, click Validate.

Answer: A

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-account-structures

NEW QUESTION 73

A client has multiple legal entities set up in Dynamics 365 for Finance and Operations. All companies and data reside in Finance and Operations, The client currently uses a separate reporting tool to perform their financial consolidation and eliminations, They want to use Finance and Operations instead.

You need to configure the system and correctly perform eliminations.

Solution: Create a separate company in which you manually create the eliminations. Then, use that company in Financial reporting or in the consolidation process.

Does the solution meet the goal?

- A. No

- B. Yes

Answer: B

Explanation:

Explanation

References:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/consolidation-elimination

NEW QUESTION 74

......

MB-310 Exam Dumps, MB-310 Practice Test Questions: https://www.actual4exams.com/MB-310-valid-dump.html

Attested MB-310 Dumps PDF Resource [2021]: https://drive.google.com/open?id=19U-LGpcjA7gclRwpQKh-_6Z9q9xRNaF5